Please log-in to report.

Africa, South America, North America, Europe, Asia, Oceania

Sign-up / Log-in to be up-to-date and informed!

Choose your News Preferences Below

Top News Stories Worldwide

Your Current Default Preferences are:

Zimbabwe Top Stories

Top Stories

for the 01 Dec - 07 Dec

< Previous week Next week >

Zimbabwe’s economy strengthened in 2025 as export earnings rose from $10B to $12B in the first nine months, driven by agriculture, mining, and manufacturing. Diaspora remittances also grew to $2.1B, helping lift foreign reserves to $950M. Finance Minister Mthuli Ncube said the country is on track to exceed last year’s $13.3B foreign-currency record, supporting currency stability and overall growth.

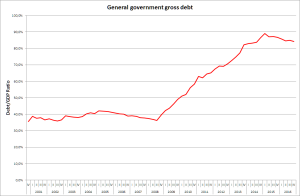

Zimbabwe’s public debt has climbed 8.5% to $23.4 billion, driven mainly by rising domestic borrowing, Finance Minister Mthuli Ncube revealed in the 2026 budget. He projected slower 2026 growth of 5% due to global headwinds, despite a rebound in agriculture and mining. Inflation is expected to fall to single digits. Talks continue with international lenders under the arrears-clearance process.

ADNOC (Abu Dhabi National Oil Company) plans to expand its fuel supply operations in Zimbabwe. Company executives met President Emmerson Mnangagwa in Harare. CEO Ahmad Bin Thalith said the company aims to deepen collaboration, increase diesel and petrol deliveries, and help keep retail prices low. He praised Zimbabwe’s business reforms for easing market entry. With fuel imports still dominant and the UAE already a key trading partner, ADNOC’s involvement is set to grow.

Zimbabwe will raise gold mining royalties to as high as 10% when prices exceed $2,501/oz, aiming to capture more revenue amid historically strong global bullion prices. The move, part of the 2026 national budget, targets major producers such as Kuvimba, Padenga, Caledonia Mining and RioZim. Government says the tiered royalty system will ensure miners contribute fairly during boom periods as gold continues to stabilise the economy and strengthen the ZiG currency.

Zimbabwe’s 2026 National Budget introduced a Digital Services Withholding Tax on payments to foreign digital platforms, replacing VAT on imported digital services. Banks and mobile money operators deducted the tax, affecting providers such as Starlink, Bolt, and inDrive. The tax raised prices unless companies absorbed the cost. Authorities said the measure closed loopholes and aligned Zimbabwe with global efforts to capture revenue from the growing digital economy.

Zimbabwe’s 2026 National Budget introduced a broad tax overhaul, cutting the IMTT on ZiG transactions while raising VAT from 15% to 15.5% to protect revenue. The plan added a Digital Services Withholding Tax, strengthened fiscal discipline, and supported Vision 2030. Despite projected growth, the country faced a deficit, rising public debt, and high spending, with critics warning the VAT increase could worsen cost-of-living pressures.