Please log-in to report.

Africa, South America, North America, Europe, Asia, Oceania

Sign-up / Log-in to be up-to-date and informed!

Choose your News Preferences Below

Top News Stories Worldwide

Your Current Default Preferences are:

Uganda Top Stories

Top Stories

for the 02 Feb - 08 Feb

< Previous week Next week >

The government committed to further capitalizing the Uganda Development Bank (UDG) by allocating an additional Shs1 trillion in the current financial year to expand lending to priority sectors. Prime Minister Robinah Nabbanja said stronger capitalization will support Uganda’s Ten-Fold Growth Strategy, NDP IV, and Vision 2040. She spoke after leadership training for UDB staff, citing the bank’s growing impact on jobs, tax revenue, and enterprise productivity.

Finance Trust Bank will move from a Tier One commercial bank to a Tier Two credit institution on April 1, 2026, after the Bank of Uganda approved the change. The downgrade follows the central bank’s increase of minimum capital requirements for commercial banks from Shs 25 billion to Shs 150 billion. The bank said the shift will not affect 95% of its customers and will let it focus on microfinance and SME services.

Uganda moved up to third place on the 2025 Absa Africa Financial Markets Index, rising from fourth in 2024. Permanent Secretary Dr. Ramathan Ggoobi said strong macroeconomic management, structural reforms, and expanding market depth drove the improvement. Uganda leads East Africa and is projected to grow 6.5–7% in 2026, with a nominal GDP of USD 68.4 billion. Authorities plan to attract venture capital and deepen financial inclusion.

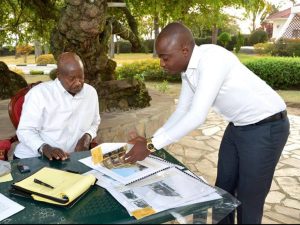

President Yoweri Museveni directed the Bank of Uganda (BoU) to ease its licensing drive for large Savings and Credit Cooperative Organisations (SACCOs) and extend their income tax exemption beyond 2027. Museveni emphasized harmonizing laws to reflect SACCOs’ member-owned structure and developmental role, rather than applying commercial bank regulations. The move halts enforcement against noncompliant SACCOs, supports financial inclusion, and tasks stakeholders with creating a tailored regulatory framework while safeguarding operations for millions of Ugandans.

Uganda is shaping its next phase of oil development around long-term investment of petroleum revenues through the Petroleum Fund rather than direct distribution. The framework channels all oil income into the fund, managed by the Bank of Uganda, to finance productive infrastructure and development projects. This approach contrasts with proposals to revise production sharing agreements and increase royalties to producing districts, which policymakers argue could weaken sustainability and long-term economic impact.

Vivo Energy Uganda commissioned an LPG filling and storage plant in Mbale City to expand access to clean cooking energy in Eastern Uganda. The facility will serve as the main Shell Gas distribution hub for the region, improving LPG availability, safety, and affordability for households and institutions. The investment supports Uganda’s clean energy agenda, reduces reliance on biomass fuels, creates local jobs, and strengthens national LPG infrastructure as the country prepares for oil production.